Claim to be a Trader? Try Trading Using This! No More Talking, Just Use This For Consistent Trading Results!

Today's Monthly NFP Data

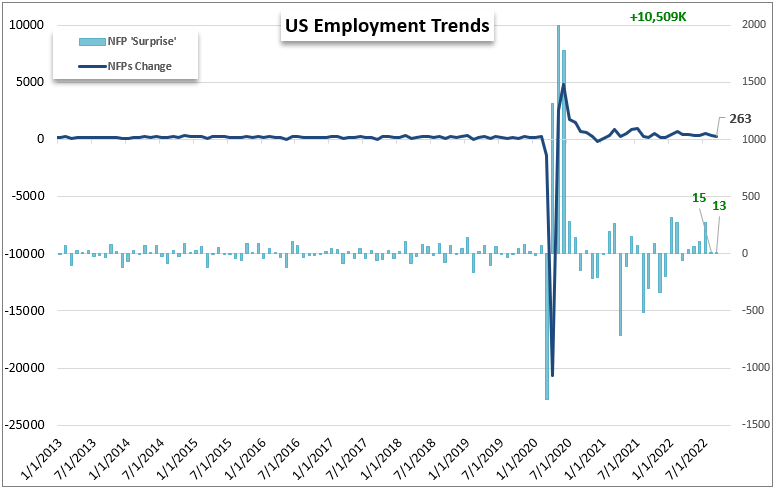

Chart Created by John Kicklighter with Data from BLS[/caption] Looking beyond the US employment data, Canada will release its own employment data at the same time as the NFP today. Then there’s the Canadian Ivey manufacturing report. Moving further into the forecast for next week, the docket will likely continue to value events that are connected to systemic themes – such as the US CPI release. XAU/USD can be particularly sensitive to situations when bond yields and the greenback move in the same direction, whether up or down. That’s because the yellow metal doesn’t provide an inherent yield for investors holding the asset. When the rate of return on cash rises, as it has this year, it tends to be a bad sign for gold. With that in mind, all eyes now turn to today’s NFP news report. The country is seen adding around 200K positions, down from 263K in September. The unemployment rate is seen ticking higher to 3.6% from 3.5%. Meanwhile, average hourly earnings are set to soften slightly to 4.7% y/y from 5.0% previously. The Citi Economic Surprise Index tracking the US has been trending up since the summer. This means that overall, economists have been underestimating the health and strength of the economy. That could open the door to a brighter outcome for today’s NFP. If so, bond yields and the US dollar could rise, putting the yellow metal at risk.

Gold Technical Analysis

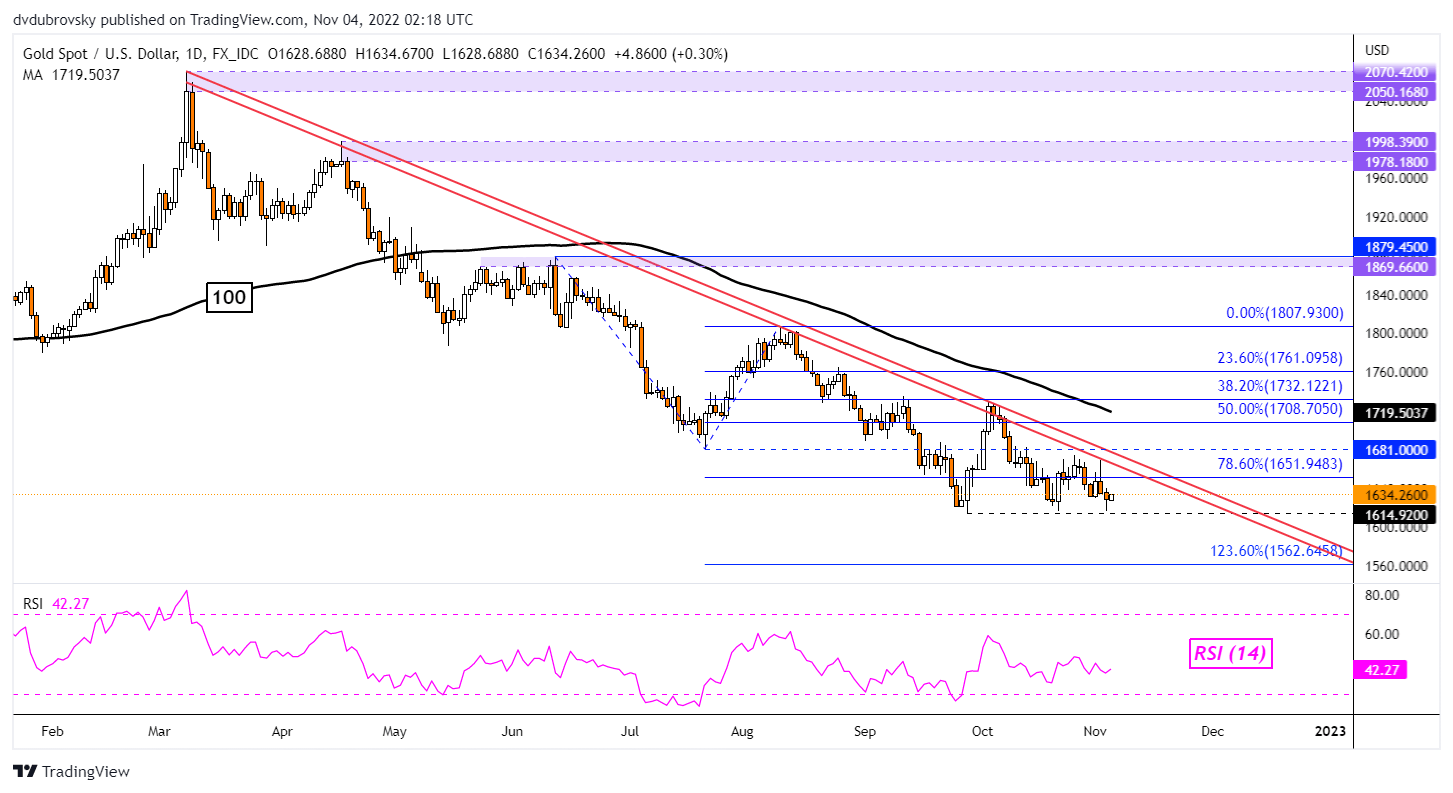

From a technical perspective, gold is consolidating just above the September low at 1614. The price is also below the long-term descending trendline from March. A break lower opens the door to a test of the 123.6% Fibonacci extension at 1562. Otherwise, a break above the trendline exposes the 100-day Simple Moving Average. The latter may act as resistance.

XAU/USD Daily Chart

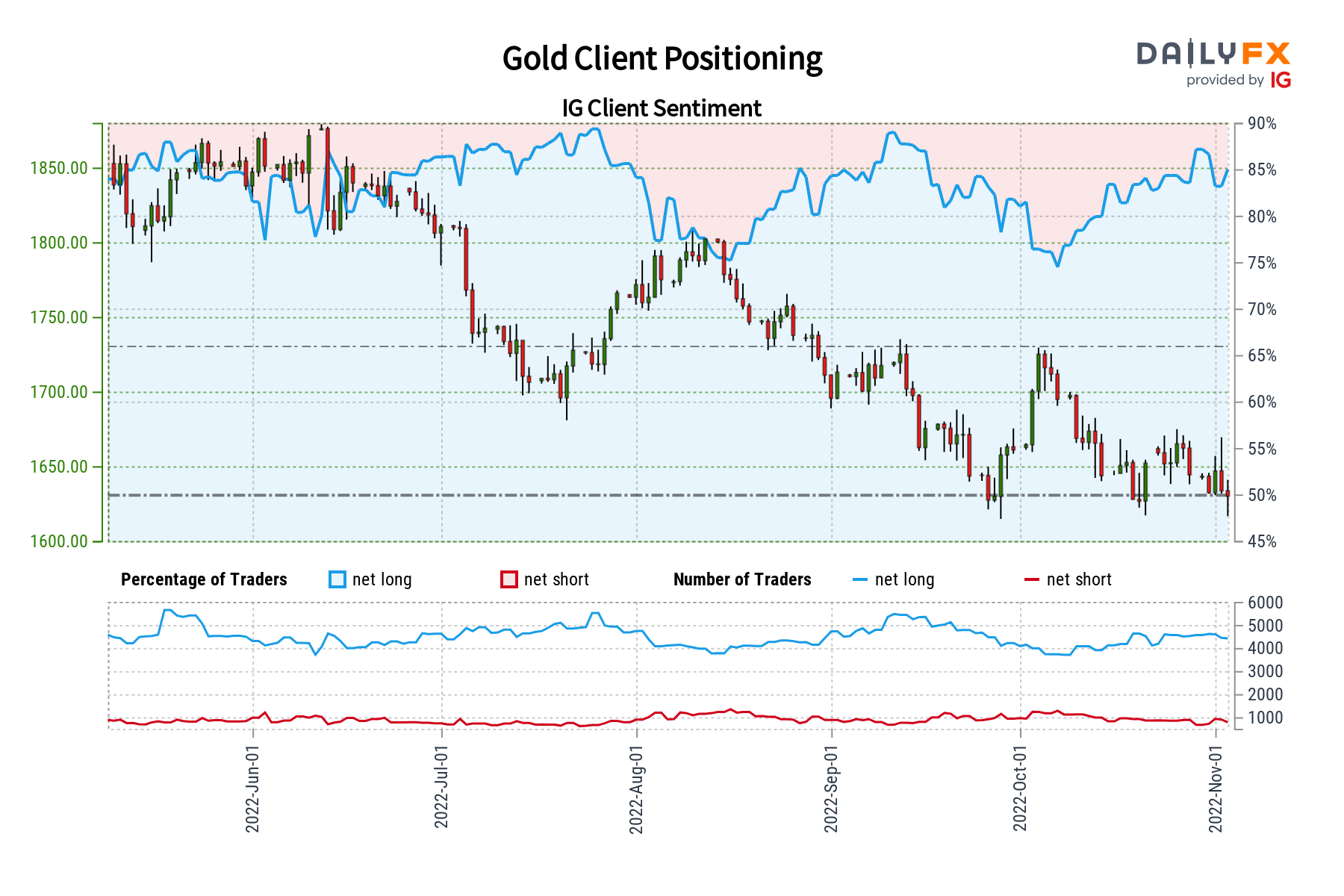

Gold Sentiment Analysis - Bearish

IG Client Sentiment (IGCS) shows that around 86% of retail traders are net-long gold. IGCS tends to act as a contrarian indicator. Since most traders are biased to the upside, it suggests that prices may continue to fall. This is because upside exposure increased by 10.37% and 7.45% from yesterday and last week respectively. With that in mind, the combination of current sentiment and recent changes offers a stronger bearish contrarian trading bias.

You Must Know! Income of 50 Million in 1 Month, Follow the Way! How to Get Tens of Millions in Profit, Follow This Tutorial!

Gold, XAU/USD, US Dollar, NFP, Today's Technical Analysis - Explained:

- Gold prices await Friday's US non-farm payrolls report

- A brighter outcome could boost the US Dollar, sinking XAU/USD

- Retail traders increase gold bets, hinting at more pain

Last:

Last: