How to Earn More than 50 Million in One Month, Follow These Steps! 2 Times Faster Earn Tens of Millions in a Short Time!

US CPI Inflation a Turning Point for Crypto Price Crash?

Crypto Prices Bounce, Fears Rise![/caption] Inflation slowed to an annualized increase of 7.7% in October from 8.2% last month, with both the headline and core readings below economists’ median forecasts. That was seen as a sign that the worst may be behind us, which would be good news for crypto. The bounce could buy valuable time for FTX founder and CEO Sam Bankman-Fried (SBF), even as U.S. regulatory agencies circle and the exchange’s legal team flees the scene. He tweeted, in a lengthy thread, that the company is in talks with a number of players regarding LOIs [letters of intent] and term sheets.

SBF claims that FTX.US, its exchange for US customers, is “100% liquid” and “unaffected by this shitshow”:

Minimize Loss Maximize Profit, Use the Following Account! Want to Earn Tens of Millions Consistently? Do This!

Crypto Contagion: Tether hits $700m in redemptions, Coinshares loses $30m, Sequoia $150m

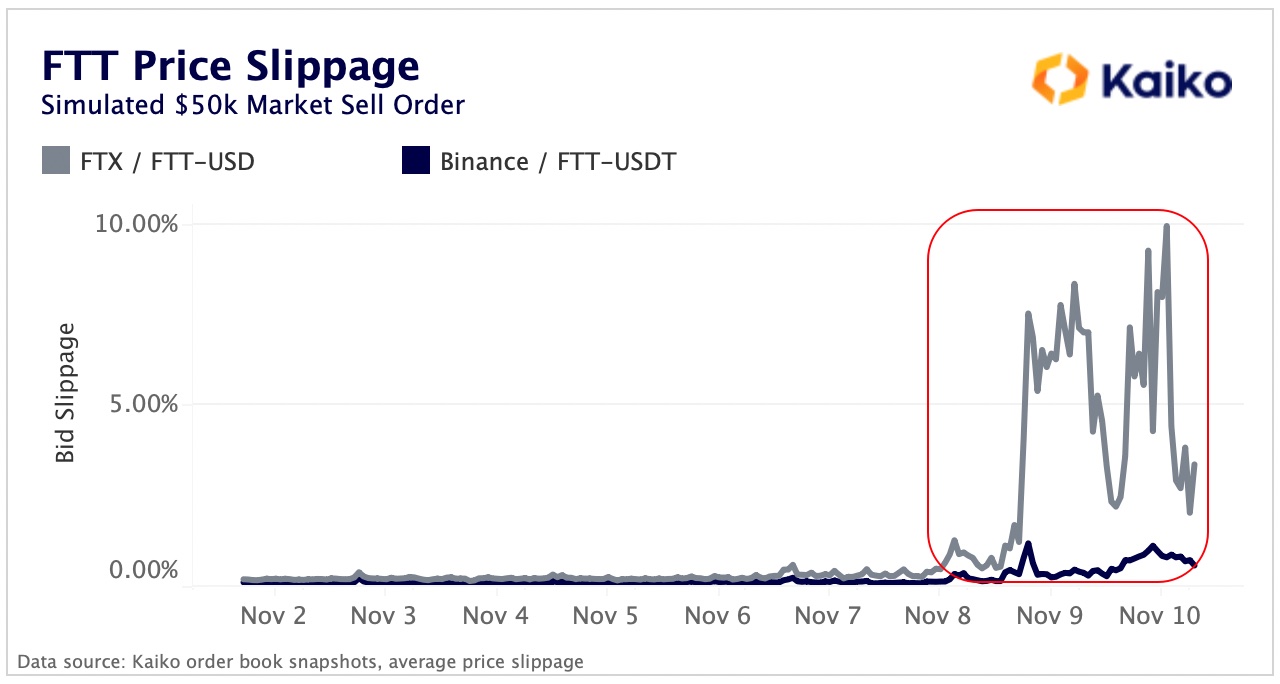

Meanwhile, stablecoin Tether at one point dropped to $0.96, losing its 1:1 peg to the US dollar. It has since recovered but as much as $700 million has been redeemed today. As the peg slips, those seeking redemptions could profit, as Tether is required to honor the peg regardless of market prices. Elsewhere, long-time crypto fund Coinshares revealed it was facing a $30 million loss tied to FTX, while Sequoia Capital took a $150 million hit. There has been no sign of contagion in another asset class, equities, although Robinhood’s share price has taken a hit in recent days due to SBF’s take on the online broker. Robinhood shares are up 7% today. Kaiko’s research team outlined the ramifications of FTX’s collapse and why it has had such a big impact on confidence. Kaiko wrote in emailed comments:The collapse of FTX has shaken the industry to its core, in part because it is a fundamentally different kind of business than crypto lenders like Celsius. FTX is a cryptocurrency exchange. The service it provides is that of a trading facilitator: it earns a transaction fee for every trade made by one of its clients. FTX is not a trading firm or a lender, so theoretically, it should have access to the equivalent of 100% of its clients’ funds at all times.”The fact that FTX couldn’t meet the withdrawals suggested the possibility that FTX had been using client funds in its own trading and lending activities. And worse, some of that lending activity looked a lot like that of sister company Alameda Research, in practice FTX’s trading arm. Also shaking the industry was the speed of the collapse. On November 6, FTT slippage — the difference between market orders and the price actually paid — began to appear, then ballooned on November 8 and became stratospheric by November 9.

Last:

Last: