Expense Ratio is very important. Calculations in investments need to be done with great care. There are various calculations that need to be made in investments themselves. One of them is the calculation of the Expense Ratio, which we will discuss in this article. But before that, download the GICTrade app and maximize your trading profits!

Expense Ratio in Investment

Expense Ratio is the percentage of your investment charged annually to manage the money you invest. The fund's expense ratio is equal to the total operating costs of the fund divided by the average net asset value of the fund. Expense ratios are charged by mutual funds and exchange-traded funds (ETFs), which are types of index funds. Many index funds have low expense ratios because they are passively managed through quantitative strategies rather than actively managed by subjective human decisions.

“In the simplest terms, the expense ratio is the convenience fee for not having to pick and trade individual stocks yourself,” says Leighann Miko, a certified financial planner (CFP) and founder of Equalis Financial. For actively managed funds, the expense ratio compensates the fund manager for overseeing the fund’s investments and managing the overall investment strategy. This includes the labor involved in selecting and trading investments, rebalancing the portfolio, processing distributions, and other tasks to keep the fund on track with its goals and objectives. If an actively managed fund employs a high-profile manager with a track record of success, you can expect it to charge a higher expense ratio. For passively managed mutual funds and ETFs, which don’t actively pick investments but aim to duplicate the performance of an index, the expense ratio includes things like licensing fees paid to major stock indexes—such as the S&P Dow Jones Indices for funds that track the S&P 500.

Expense Ratio Components

The expenses incurred by the fund house are recovered from the investors on a daily basis. This is communicated to the investors every six months. The expense ratio impacts the return you take home. There are several types of costs associated with the expense ratio of a mutual fund, such as:- Manager Fees - Every mutual fund has an investment objective and it is the decisions of the fund manager that ensure that objective is met. The expense ratio of an actively managed mutual fund includes compensation to the fund manager as part of the expense ratio. For passively managed mutual funds, this component of the fund's expense ratio is much lower than for actively managed funds, since the fund manager does not have to actively manage the fund's portfolio in the former.

- Legal/Audit Costs - Mutual funds are regulated by the Securities and Exchange Board of India, and hence, to comply with all the rules and regulations, they require legal intervention and constant auditing of their processes, schemes, etc. Any costs related to audits, registrations and transfers, legal checks, etc., are also a part of the expense ratio.

- Marketing/Distribution Costs – Costs related to marketing the mutual fund, creating awareness and then distributing it through mutual fund distributors are part of the expense ratio. The brokerage cost component is lower for direct funds and higher for regular funds because when you invest in regular funds, there are charges for brokers like distributors. These charges are also known as brokerage charges. Hence, investing in direct funds through ET Money will prove to be cheaper than regular funds. The previous section on marketing and distribution of pamphlets also includes 12B-1 charges.

Expense Ratio Function

Expense ratios are very important because they let investors know how much they are paying in fees by investing in a particular fund and how much their returns will be reduced. The lower the expense ratio, the better because it means that investors are receiving a higher return on their invested capital. In most cases, the expense ratio is the total cost of operating the fund divided by the fund’s assets. The higher those operating costs, the higher the expense ratio, which is why actively managed funds often have higher expense ratios. Actively managed funds are managed by humans, not computers. As an individual investor, the amount you will pay each year is a percentage of the amount you invest. For example, an index fund has an expense ratio of 0.5% and you have $10,000 invested in the fund. You will pay about $50 per year in operating expenses. You will not receive a bill for the expense ratio portion of your fund. Instead, that amount is deducted from your investment returns.

Is a High or Low Expense Ratio Better?

To determine how good an expense ratio is, measure it against a simple average if you want to see how it ranks overall from top to bottom, but also measure it against an asset-weighted average to see how much investors are paying for their funds. Ultimately, look for funds that are below the asset-weighted average. As far as expenses go, the lower the better. The answer to whether an expense ratio is good really depends on what else is available across the industry. So let’s take a quick look at what’s been going on. Expense ratios have been falling for years, as cheaper passive ETFs have claimed more assets, forcing more expensive traditional mutual funds to lower their expense ratios. You can see the numbers for both mutual funds and ETFs in the chart below.A number of factors determine whether an expense ratio is considered high or low. A good expense ratio, from an investor's perspective, is around 0.5% to 0.75% for an actively managed portfolio. An expense ratio greater than 1.5% is considered high.

Expense ratios for mutual funds are typically higher than expense ratios for ETFs. 2 This is because ETFs are passively managed. The assets held in them are selected to mirror an index such as the S&P 500, and changes to the selection are rarely necessary. Mutual funds, on the other hand, are actively managed. The assets held in them are constantly monitored and changed to maximize the fund’s performance.

What is the Impact of Expense Ratio on Investment?

Mutual fund expense ratios are important to investors because a fund’s operating and management costs can have a significant impact on its net profitability. The expense ratio for a fund is calculated by dividing the fund’s total expenses—both management fees and operating expenses—by the fund’s total asset value.

The expense ratio for mutual funds can vary significantly. The expense ratio for index funds is typically much lower than for actively managed portfolio funds, averaging 0.06% in 2020. The expense ratio for actively managed funds averaged 0.71% in 2020, though some funds have much higher ratios.

Most investors are unaware of the significant impact that seemingly small differences in expense ratios can have, but an example easily shows that even a relatively small difference can have a significant effect on net investment returns.

Consider two mutual funds, both generating an average annual return on investment of 5%, with one fund charging 1% and the other charging 2%. A single percentage point difference may not seem significant to most investors, but that's because the fees are based on assets managed, not profits earned.

Assume two investors start the year with $100,000 invested in 1% and 2% expense ratio funds, respectively, and each fund earns a 5% return on investment before fees are deducted. The investor who is charged the 1% fee loses $1,000 (1% of $100,000) of his $5,000 profit to fees. The investor who pays the 2% fee pays $2,000 of his $5,000 profit. Thus, a small 1% difference in expense ratios translates into a whopping 10% difference in net income.

How to Calculate Expense Ratio?

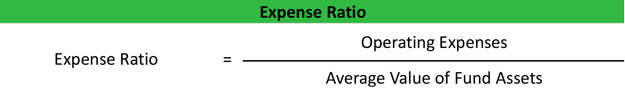

Expense ratio is a very important calculation. The expense ratio is calculated by dividing the fund's total annual operating expenses by the average value of total assets under management.- Expense Ratio FormulaExpense Ratio = Total Annual Operating Expenses / Average Fund Assets

- Expense Ratio = $200 million / $2 million = 1.0%

- Operational Expenses = $400.000 * 0,50%

- Operating costs = $2,000

Expense Ratio Formula

To make it easier to understand the formula, you can see the explanation below. The expense ratio formula is calculated by dividing the mutual fund's operating costs by the average value of the mutual fund's assets.

As you can see, only operating expenses are used in the expense ratio equation. Commissions and sales loads are not included. These costs are not related to the day-to-day running of the fund. Rather, they are front- and back-end, one-time costs that are only paid when an investor invests in the fund or sells assets in the fund. Also, any trading activity within the fund is not included in this calculation.

How to Find the Fund Expenditure Ratio

The Securities and Exchange Commission (SEC) requires funds to publish their expense ratios in their prospectuses. A prospectus is a document that outlines key information about ETFs and mutual funds, including the fund’s investment objective and manager. If you use an online broker, you can usually find a fund’s expense ratio using the platform’s research tool. Many online brokers also have fund comparison engines that allow you to enter multiple fund tickers and compare their expense ratios and performance side by side. You may see a gross expense ratio and a net expense ratio. The difference between these two numbers relates to some of the incentive funds that companies use to attract new investors through fee waivers and expense reimbursements.

- Gross expense ratio is the percentage an investor will be charged without fee waivers and reimbursements. Investors need not worry about this number if there is a net expense ratio listed.

- Net expense ratio is the actual cost you will pay as an investor to hold shares in the fund after you receive the benefit of fee waivers and expense reimbursements.

To learn the difference between ER and Mutual Fund AUM, make sure you complete the trader assessment first to be able to consult with trading experts at GIC.

What is the Difference between Expense Ratio and AUM in Mutual Funds?

In a mutual fund prospectus, after the expense disclosure is a section called “Annual Fund Operating Expenses.” This is more commonly known as the expense ratio. It is the percentage of assets paid to run the fund. Well, most of them. Many expenses are included in the expense ratio, but usually only 3 are broken down: management fees, 12b-1 distribution fees, and other expenses. And, it’s not easy to figure out what expenses fall under the “other expenses” category. In addition to paying the portfolio manager’s salary, management fees include the cost of the investment manager’s staff, research, technical equipment, computers, and travel expenses to send analysts to meet with company management. While fees vary, the average management fee for a stock mutual fund is around 1.40%. Most ETFs track a market index, while mutual funds are more likely to be actively managed. Active management can be a good thing if the fund manager is talented and able to outperform the market. However, there are no guarantees and you may still pay higher fees for a mutual fund than a passively managed ETF over the long term.

AUM (Asset Under Management)

Assets under management is the total market value of assets/capital held by a mutual fund. The fund manager manages these assets and makes all investment decisions on behalf of the investors. AUM is an indicator of the size and success of a particular fund house. You can easily compare the fund’s assets under management across multiple timelines and performance with other similar schemes. The AUM value also includes the returns earned by the mutual fund. The asset manager can invest it in securities, distribute it to investors as dividends, or retain it as per the investment mandate. Mutual fund investors often look at the AUM of a mutual fund and get impressed if it is on the higher side. People think that if so many investors have invested in the fund, then it must be good. However, there are many reasons why this number should not be a significant factor while choosing a mutual fund. Expense ratio, reputation of the fund manager, and adherence to investment mandate are some of the most important factors to consider. Let us dissect the importance of AUM for different types of funds.

Benefits of Calculating and Knowing the Expense Ratio

The advantage of Expense ratio is that we can know through the example below. Let's take an example of calculating the expense ratio of mutual funds for Axis Bluechip Fund to understand the impact of the expense ratio on returns.| Axis Bluechip- Reguler | Axis Bluechip-Direct | |

|---|---|---|

| Expense Ratio | 1,83% | 0,5% |

| Amount of investment | Rs 10.000 per month | Rs 10.000 per month |

| Investment Mode | Take a sip | Take a sip |

| Investment period | March 1, 2016 - March 1, 2021 | March 1, 2016 - March 1, 2021 |

| Total investment amount | Rp 6.000.000 | Rp 6.000.000 |

| Amount due | Rs 9.01.497 | Rp 9.34.500 |

| Annual returns | 15,9% | 17,34% |

As you can see, both the annual returns and the maturity corpus vary for regular and direct plans. This is because the expense ratio is higher for regular plans, which reduces your returns. This difference of around Rs 33,000 over five years can add up and increase manifold over time due to compounding. Also, remember, the expense ratio is not static. Rather, it is a % of the investment value. Hence, as the investment value grows, so does the contribution of your expense ratio. This is your hard-earned money that needs to be saved. So, investing in direct plans is a smarter way to invest. After knowing about the Expense Ratio along with how to calculate it and how it affects your investments, you can then apply the calculation to the investments you are going to make in the future. Once you know everything discussed above, take the GIC trading aptitude test and find out how far your trading skills are!

Last:

Last: