What is a Pending Order

In Forex trading, it often happens that novice traders have to sit for days in front of the monitor, waiting for favorable conditions to enter a trade. At the same time, not all of them think about whether it is worth immediately buying or selling an asset at a price that seems attractive at the moment? There are many ways to make it easier for a trader to trade and shorten their waiting time without losing profit from the transaction.

Limit orders can only be executed at the limit price specified by the trader. There are two types of limit orders; a buy limit order instructs that an instrument be bought at a specified price or lower while a sell limit order instructs that an instrument be sold at a specified limit price or higher.

Because Limit orders guarantee that the order will be filled within a specified limit or not at all, they are useful for preventing slippage. However, while they can prevent slippage, they run the risk of not being filled during times of high volatility. Stop orders instruct that a position be opened or closed when a specified price is reached and are widely used to lock in profits and minimize losses.

For example, if you want to sell from 1.1828 and place a sell stop order but the market is falling so fast that the broker will execute the order only if the market is available. And that might be 1.1825 or 1.1823, and the three pip difference represents slippage and this is a significant cost if you are scalping in and out of the market for a ten pip strategy or something like this.

One of these methods is a pending order. A pending order is an instruction to open or close a trade if the price reaches, or passes a level that you have previously specified. Therefore, a pending order becomes an open order, once triggered.

This is very useful when you do not have time to constantly monitor the market. Simply decide the price you want to trade at, and the system will do the rest. A pending order is an instruction to buy or sell an instrument when certain conditions specified by the trader are met.

Essentially, when placing this order, the trader informs their broker that they do not want the current market price, but they only want their order to be executed if the market price reaches a certain level. Pending orders fall into two categories, limit orders and stop orders.

Limit orders can only be executed at the limit price specified by the trader. There are two types of limit orders; a buy limit order instructs that an instrument be bought at a specified price or lower while a sell limit order instructs that an instrument be sold at a specified limit price or higher.

Because Limit orders guarantee that the order will be filled within a specified limit or not at all, they are useful for preventing slippage. However, while they can prevent slippage, they run the risk of not being filled during times of high volatility. Stop orders instruct that a position be opened or closed when a specified price is reached and are widely used to lock in profits and minimize losses.

Buy stop orders are placed above the current market price and sell stop orders are placed below the current market price. Although stop orders are often confused with limit orders, they differ in a key aspect; when the market price reaches a level specified by the trader, a market order is then automatically placed. As such, in times of high volatility they may be subject to slippage and poor filling under certain market conditions. These are the four types of trades used when trading financial markets with MetaTrader4. Others exist, such as One-Cancels-Other.

With this order, you can place this order above or below the current market, and if the market reaches one pending order, the other will be automatically canceled. But such orders are not in the default settings, you need to integrate a new indicator in the platform – not that it is difficult to do so. Therefore, it is worth remembering that if we want to buy from a higher price, we use a buy stop order, and when we want to buy from a lower level, we use a buy limit order.

Whenever we want to sell from a higher level, we use a sell limit order, and a sell stop order when we want to sell from a lower level. A buy stop order takes advantage of market strength. A sell stop order takes advantage of market weakness. These four orders indicate that there is money management in place, a trading plan. We want to act only if the market reaches a certain level.

This is very important because one of the big mistakes that retail traders make is that because the market is open, they feel they need to do something. Well, sometimes the market doesn’t move. In fact, it consolidates most of the time, it doesn’t travel all the time. So, sitting on your hands is a position that you have in the market, in the sense that you don’t want to risk your capital if the market doesn’t move.

If we place any of these four pending orders and if EURUSD spends the next 24 hours or day without reaching this level, then we effectively save capital because the market isn’t moving anywhere. So that’s one of the advantages of these orders – it indicates money management in place, a trading plan and avoids wasting margin.

Another advantage is that by using pending orders, you can influence how you adjust the leverage and margin in your trading account. If we believe that EURUSD will move above 1.20 and we place this order to buy at 1.20 and then the market reverses, we have the opportunity to buy again but only if the market makes a new high with another pending order.

The disadvantage of pending orders is that they are often affected by slippage. Slippage occurs when you have an active pending order and then important economic news, such as the NFP in the United States or any news that has the potential to create rapid market activity comes and the broker executes your order with slippage.

For example, if you want to sell from 1.1828 and place a sell stop order but the market is falling so fast that the broker will execute the order only if the market is available. And that might be 1.1825 or 1.1823, and the three pip difference represents slippage and this is a significant cost if you are scalping in and out of the market for a ten pip strategy or something like this.

Pending Order Function

The money management system is based on a plan. That is, the trader already knows how much to risk on each trade, the entry and exit levels, and what the next move should be. The only thing that is difficult to estimate is the time it will take for the trade to reach the target. If the analysis is wrong, the trade may be stopped earlier than expected. Even if the analysis is correct, the market may take an unexpectedly long time to reach the target.

Some patterns do take into account time analysis – for example, flags, pennants, and even the Elliott Waves theory. However, the best way to control time and implement a good money management system is to use pending orders. Plan your trades and trade your plan. This is what using pending orders suggests – having a plan. Traders who use a plan have a huge advantage over traders who use random systems.

However, building a plan and executing it is a completely different process. Patience is key. Depending on the time frame the analysis is based on, it may take days, weeks, or even longer for the price to reach the desired level.

In addition, traders who use pending orders are often “ahead of the curve.” Effectively, this means that the market may continue in the opposite direction for some time before reacting. The advantages of using pending orders are that they allow traders to:

- Buy with power – buy stop order in a trending market

- Sell into weakness – perintah hentikan jual di pasar yang sedang tren

- Buy into weakness – beli pesanan batas sebagai perdagangan kontrarian

- Sell to power – jual batasi pesanan sebagai perdagangan kontrarian

So, by planning where to enter and exit, traders have an easier task of setting the right risk-reward ratio. Another advantage is avoiding overtrading. When using pending orders, the market must move to a certain level. Otherwise, the order will not be filled.

Without pending orders, traders tend to open many trades in the market only to see that the price action does not reach the desired level and reverses sharply, triggering a loss.

The biggest advantage of pending orders is that they foster discipline and patience rather than chasing price, something that can easily happen when using market execution. There is no single group of traders who enter this way because some trading systems work well. For example, some news trading strategies require pending buy and sell orders rather than instant ones.

Others who trade using some form of supply and demand or even support and resistance may use this type of execution based on their beliefs about what price might do in a particular area.

Also, another good thing is through pending orders. There is no commitment until the price reaches a predetermined level. Therefore, it is easier to change one's mind and cancel the order (or set an expiration date) at any time if one feels the trade is not worth considering.

Pending Order Types

Here are some types of pending orders that you can apply to the trading you are doing. These types are:Buy Limit

A pending buy limit fulfills the same function, only the trader expects the market to fall first and then buys the asset. A pending buy limit order is usually used when trading an uptrend, and expects the price to fall to support the area provided by a moving average or an uptrend line.

Sell Limit

The opposite is true when using a pending sell limit order – the trader wants to sell from a higher level, from resistance. This is especially useful when trading on larger time frames, such as the monthly chart of the EURUSD pair seen below.

By examining the left side of the chart, traders can see that price tried three times to break through support in the past and failed each time. Therefore, it is a strong support level that should offer resistance. By placing a pending limit sell order when price reaches resistance, they stand to be there for the market’s first reaction.

Buy Stop

Such orders are used to buy from higher levels. For example, if EURUSD is trading at 1.1975 and has a bullish tone, some traders may expect the momentum to continue the breakout above 1.20.

Since the breakout time is unknown, a pending buy stop order is recommended. This will fill the order when price moves higher, regardless of whether the trading platform is open or not.

Since the breakout time is unknown, a pending buy stop order is recommended. This will fill the order when price moves higher, regardless of whether the trading platform is open or not.

Sell Stop

Sell stop orders are used to sell into weakness. More specifically, think of a descending triangle. The market usually pushes through horizontal support and eventually breaks it. To ensure they participate in the breakout and add to the weakness, traders place pending sell stop orders to push price even lower.

How to Use Pending Orders

A pending order is an order that is set to be executed when a desired price is reached. Before we look at how to set one up, let’s take a look at what options are available. The types of orders available are:| MT4 | MT5 |

| Buy Limit | Buy Limit |

| Sales Limit | Sales Limit |

| Buy Stop | Buy Stop |

| Sell Stop | Jual Sell Stop |

| Buy Stop Limit | |

| Sell Stop Limit |

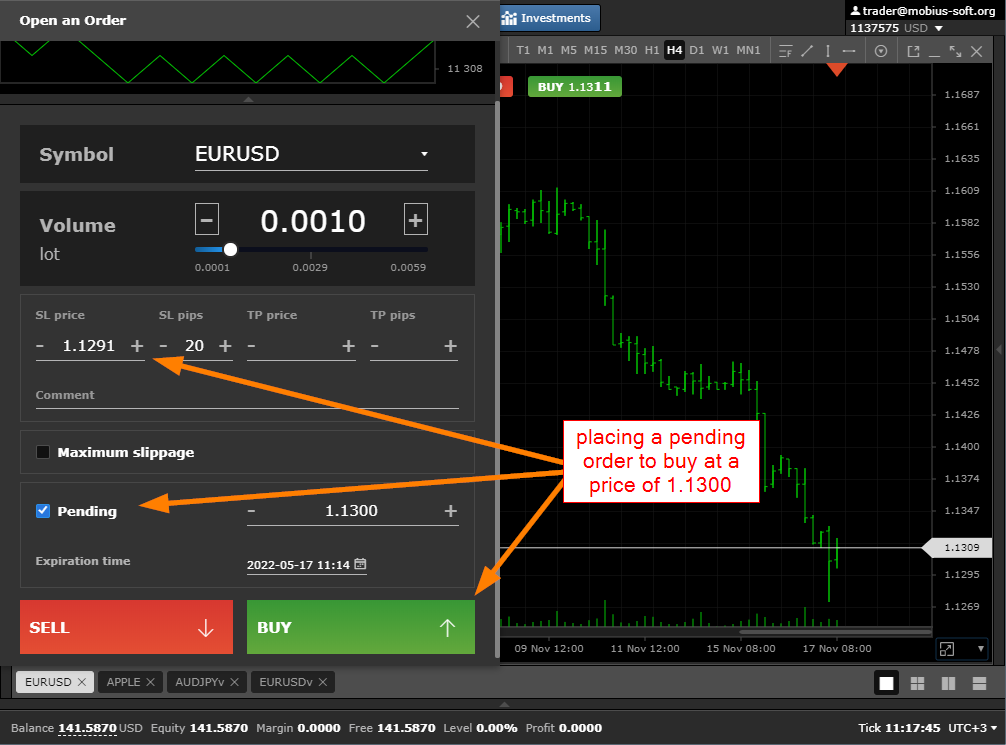

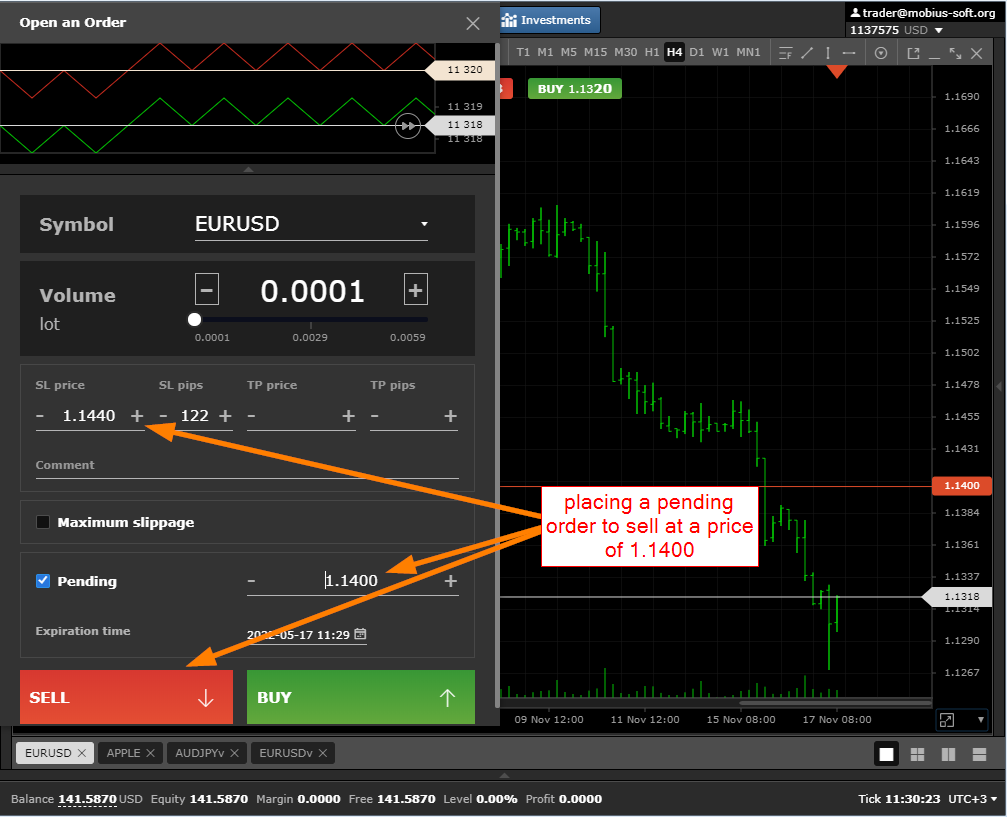

Now, let us walk you through the steps to set up pending orders on a mobile terminal.

iOS (MT4 and MT5)

On the iOS platform, follow the steps below:

- First, find the Trade option. There are three ways to do this:

- Go to the Quotes tab and tap the instrument of your choice.

- Go to the Charts tab and tap anywhere to open the menu.

- Open the Trade tab and click the + symbol in the top right corner of the screen.

- Once you find the Trade window, click on the execution type displayed and select pending order.

- Once you have selected a pending order, set the following parameters:

- Order Volume

- Prices for pending orders (You need to set additional prices for Buy Stop Limit and Sell Stop Limit)

- Stop Loss (optional)

- Take Profit (optional)

-

Expired

Android (MT4 and MT5)

On the Android platform, follow the steps below:

- First, look for the New Order option. There are three ways to do this:

- Go to the Quotes tab and tap the instrument of your choice.

- Go to the Charts tab and tap the + symbol in the top right corner of the screen.

- Open the Trade tab and tap the + symbol in the top right corner of the screen.

- Once you find the New Order window, click on the execution type displayed and select pending order.

- Once you have selected a pending order, set the following parameters:

- Order Volume

- Prices for pending orders (You need to set additional prices for Buy Stop Limit and Sell Stop Limit)

- Stop Loss (optional)

- Take Profit (opsional)

- pending sell-order means the order "sell the asset at the price specified in the order (in the picture below you see the necessary actions for this select the" pending "checkbox, set the desired price in the additional window and click the sell button)

The advantage of trading using pending orders is that there is no need for a permanent presence in the trading terminal. The disadvantage is that if the level for entering pending orders is incorrectly specified, they will remain in the pending status.

It should be remembered that pending orders set at a price better than the current one (sell above the current market, buy below the current market) are copied to the order glass and also require a promise.

If you want to open a pending order at a price worse than the current one (for you), for example, if the current price is 1000 and you want to buy at 1100 or sell at 900 (if the price reaches this level) your application is not visible in the price glass. Gap in pending orders. Gap is the difference in prices in quotes.

Depending on the cause of the occurrence (usually unexpected or very strong information), it can reach hundreds of points. Recent examples are the 2017 French presidential election and the British parliamentary elections. In both cases, it was a question of hundreds of points.

What should you always remember in the context of the appearance of gaps when trading pending orders? In this case, the order will be opened at the first market quote after the price gap. Read your broker's rules carefully. And re-read the conditions for the execution of all types of pending orders described in the article above.

And remember that the price at which you want to open a deal may differ from the expected one by several hundred points if it falls into this price gap. It is especially unpleasant if it is a stop loss.

Take profit is always executed at the installation price from the moment they enter the order book. As can be seen from the figure below, the first round of the presidential elections in the Fifth Republic cost EURUSD almost two hundred points.

Friday's closing level is 1.0723, Monday's opening level is 1.0917. Everyone who opened sell positions on Friday suffered losses, because the previous local maximum, which was broken through by this gap, was the technically correct level for stop loss.

And gamblers, with pending buy orders set above 1.0790, got positions at prices much worse than expected. After learning what a pending order is, along with its types, functions, and how to use it, you can apply this pending order to the trading you are currently doing.

In addition, you can do your own trading using the GICTrade application by downloading it via the App Store or Play Store! Also, join the GIC Trading Competition and get the prize!

Last:

Last: