Taper Tantrum is a term for the effect of the announcement of the United States (US) monetary policy. This has caused several economic movements to be greatly disrupted due to the taper tantrum. Such as the outflow of foreign funds to the country of origin or everything related to interest rate policies. Before explaining the taper tantrum, invite your friends or become an IB GIC affiliate. Get additional benefits when you join GIC Affiliate.

What is a Taper Tantrum?

“Tapering,” a phrase that has come into play in the world of monetary policy, refers to a central bank’s strategy of ending its quantitative easing program, which was used to buy government debt and other assets to keep borrowing costs low. Tapering can be described as a plan to ‘taper’ or ‘reduce’ Quantitative Easing (QE) or to gradually stop investing money into the economy and banks. The central banking system does this by reducing bond purchases over an extended period to slowly wean the economy off the extra stimulus the purchases provided to avoid a downturn.Understanding Taper Tantrums

In 2013, the US Federal Reserve decided to wind down its bond-buying program (known as quantitative easing) that it had started in response to the 2007–2009 global financial crisis and recession, leading to a sudden sell-off in global bonds and stocks. As a result, many emerging market economies, which had received large capital inflows, experienced currency depreciation and capital outflows. Eventually, the phase became known as the ‘taper tantrum’. Global markets were spooked at the Fed’s first hint that it might unwind its monetary stimulus in what became known as the taper tantrum. The Fed’s tightening of its asset-purchasing power triggered US Treasury yields to race higher in 2013, an episode in financial markets dubbed the ‘taper tantrum’. The Fed was only able to start shrinking its balance sheet in 2017, nine years after it began expanding it during the global financial crisis. In India, foreign institutional investors (FIIs) withdrew money from bonds and equities, and the rupee plunged by over 15 percent between May 22 and August 30, 2013. As a result, the Reserve Bank of India (RBI) had to raise interest rates to control the outflows. Emerging markets including India are vulnerable to the impact of the US Federal Reserve’s decision to scale back its quantitative easing program. The reduction in the US Fed’s monthly liquidity injections into the economy is affecting inflation in these emerging economies despite the positive impact of currency depreciation on their external imbalances.Signs of a Taper Tantrum

There are many factors that drive the US central bank to tighten monetary policy, which can lead to a taper tantrum. However, the most common signs of a taper tantrum can be seen from two main indicators, namely inflation data and US treasury yields. The US treasury yield at that time had risen to around 1.6%. It is even estimated that it will continue to climb to 1.9%. Meanwhile, US inflation continues to increase. In April, US inflation reached 4.2%. These are signs that have been seen after the government poured out a jumbo stimulus worth USD 1.9 trillion which was distributed to its residents. The threat of a taper tantrum will also have an impact on the rupiah exchange rate. Before continuing on to the impact of this taper tantrum on the economy, you can fill out a user satisfaction survey so that we can fix the shortcomings of our platform.The Impact of Taper Tantrum on the Economy of Major Countries

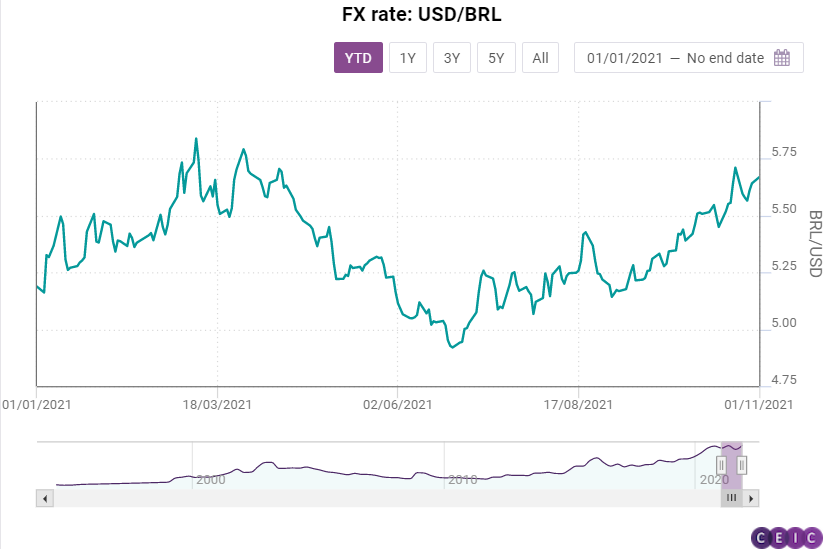

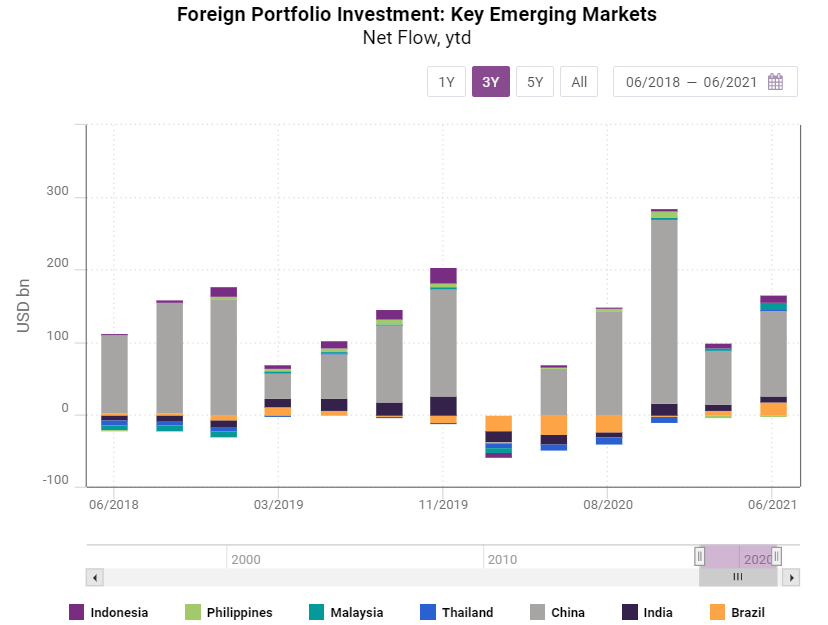

For emerging markets, the main concern stemming from the QE tapering plan is the potential for capital outflows, as the US dollar may strengthen on the back of rising interest rates in the US. This, in turn, could lead to weaker EM currencies and interest rate hikes by local central banks. This has already happened in Russia and Brazil. In Latin America’s largest economy, the central bank raised its policy rate Selic by 1.5 pp to 7.75% per annum during its meeting in late October. Whether emerging markets will witness another taper tantrum or not is difficult to predict and depends on a variety of policy moves and market movements. Furthermore, forecasting has proven to be a very risky venture over the past two years and even the most confident pundits refrain from it. In this regard, the aim of this insight is to provide relevant indicators for major emerging markets in one place, which will help monitor capital inflows and outflows from major emerging markets. The main coverage includes the net balance of foreign portfolio investment from the World Trend Plus database, allowing for cross-country comparisons. This is the balance between portfolio investment in each country and portfolio investment held by those countries abroad.

Whether emerging markets will witness another taper tantrum or not is difficult to predict and depends on various policy moves and market movements. Furthermore, forecasting has proven to be a very risky venture over the last two years and even the most confident pundits refrain from it. In this regard, the aim of this insight is to provide relevant indicators for major emerging markets in one place, which will help monitor capital inflows and outflows from major emerging markets. The main coverage includes the net balance of foreign portfolio investment from the World Trend Plus database, allowing for cross-country comparisons. This is the balance between portfolio investment in each country and portfolio investment held by those countries abroad.

The sectoral index champions are the utilities, energy and basic materials sectors. Daily transactions reached IDR 11.05 trillion and net buying in the regular market was worth IDR 316.71 billion. Meanwhile, in the debt market, the prices of the majority of government bonds or Government Securities (SBN) closed higher again in trading, after the Fed will start tapering at the end of the month.

The majority of investors are again busy hunting for SBN, marked by the weakening yield. Only long-term SBN, namely 25 and 30 years, tend to be released by investors and experience a strengthening yield. Reporting data from Refinitiv, the yield of 25-year SBN strengthened by 0.4 basis points (bp) to 7.183% and the yield of 30-year SBN increased by 0.2 bp to 6.828%. Meanwhile, the yield of 10-year SBN, which is the benchmark yield for government bonds, fell again by 0.3 bp to 6.225%.

Yield is inversely proportional to price, so a decrease in yield indicates that bond prices are strengthening, and vice versa. The basis point unit of calculation is equal to 1/100 of 1%. After knowing about the impact on the world economy, we can then find out the impact on the Indonesian economy. Before that, take your trading talent test through a preliminary test from GIC.

The Impact of Taper Tantrum on the Indonesian Economy

The last time the Federal Reserve moved to reduce its bond purchases, it triggered a rush of funds out of emerging markets. This time is different, investors say, as they bet on broadly shining gains in some of Asia’s largest developing nations.

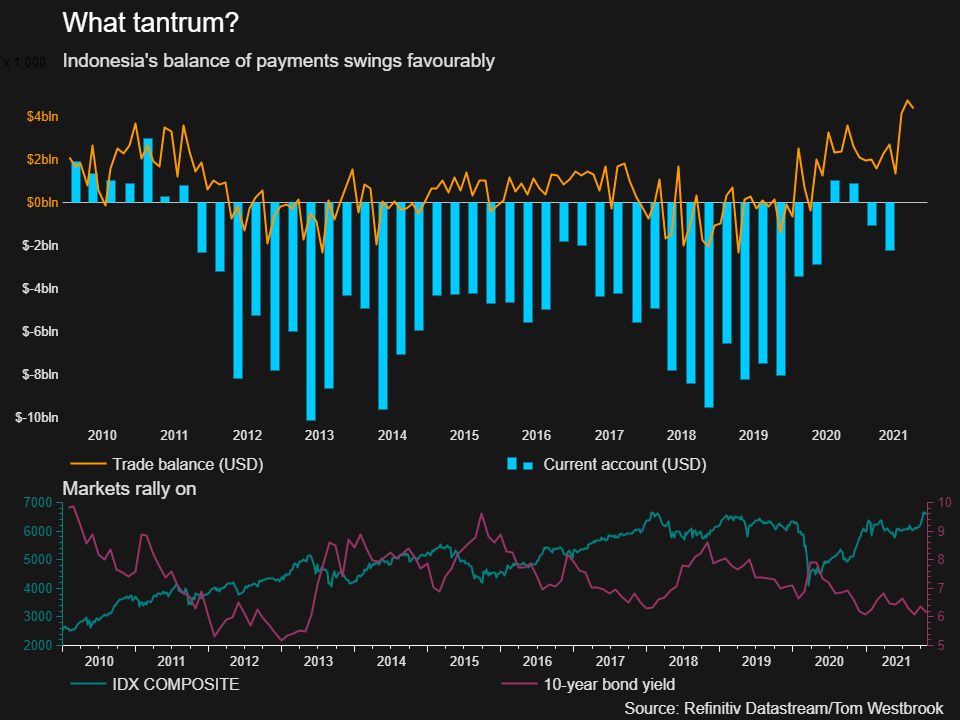

Indonesia, in particular, has stood out with equity inflows, a stable currency and even the calm of its notoriously volatile bond market through months of short-term talk ahead of Wednesday’s announcement that the Fed would begin tapering purchases.

It’s a far cry from the “tantrum” that hit emerging-market bonds and currencies in 2013 — sending the rupiah down about 17% in five months — after Fed Chairman Ben Bernanke shocked markets by mentioning tapering to Congress.

This time the move was much better telegraphed, and few were surprised on Wednesday. But fundamentals in Asia, where inflation is less pressing and exporters are benefiting from high energy prices, have also changed dramatically, and investors are increasingly betting that 2013 will not be a repeat. There’s also China’s economy and volatile credit markets and commodity prices, as well as equity flows that are supporting Indonesia’s currency.

Enthusiasm for the upcoming listings has drawn cash into Indonesia’s stock market, and the Jakarta benchmark exchange (JKSE) is heading for its best year since 2017, with indexes in Thailand, Vietnam and India eyeing similar milestones.

Soaring prices for coal and palm oil — Indonesia is the world’s second-largest exporter — have also swung Indonesia’s trade surplus to record levels and promised a tax windfall that has soothed investors in sovereign bonds.

In Indonesia, data from the Indonesian Central Securities Depository showed the number of investors in stocks rose more than 70% in the year to Oct. 19 to 6.7 million. Global investors are also circling, with investors spooked by regulations in China looking to put their money to work in other emerging markets.

To be sure, destinations like Indonesia remain risky and vulnerable to capital flight if low-risk U.S. interest rates rise sharply. The decline in foreign ownership of government bonds highlights particular caution about the growth outlook, especially as the government is legally bound to reduce its deficit.

For the cause of the taper tantrum itself, we will discuss it later. However, make sure you consult with GIC through trader assessment.Causes of the 2013 Taper Tantrum

In 2013, Federal Reserve Chairman Ben Bernanke announced that the Fed would reduce its bond purchases in the future. In the period since the 2008 financial crisis, the Fed has doubled the size of its balance sheet from about $1 trillion to about $3 trillion by buying nearly $2 trillion in Treasury bonds and other financial assets to prop up markets.Chronology of Events

JAN. 29-30 POLICY MEETING

The future of bond purchases has been under the microscope since the beginning of the year. Policymakers have debated the costs and benefits of a third round of purchases that began in September 2012.

Unemployment is running at 7.9 percent and the Fed’s preferred measure of inflation — the personal consumption expenditures (PCE) price index excluding food and energy — is running at 1.7 percent. The Fed’s balance sheet stands at $2.75 trillion and is growing by $85 billion a month.

Powell wants to end quantitative easing, calling for a plan to taper bond purchases and “end them by the end of the year.”

The policy-setting Federal Open Market Committee voted to keep the program in place, though Kansas City Fed President Esther George delivered the first of her seven policy dissents in 2013.

POLICY MEETING MARCH 19-20

Fed officials began discussing in earnest what they would eventually agree to: Returning the Fed’s balance sheet to a more normal size through a gradual process that would allow bonds to flow as they mature, rather than sell them.

Unemployment in February was 7.7 percent, core PCE inflation was 1.6 percent and the central bank’s bond portfolio was at $2.94 trillion. No policy changes were made, and George again dissented.

POLICY MEETING APRIL 30- MAY 1

Some Fed policymakers came around to the idea that the June 18-19 meeting would be a good time to start tapering bond purchases, though that was not publicly known at the time.

Powell was among them, arguing that the Fed should take “the next reasonable and plausible opportunity to taper.”

Unemployment in March was 7.5 percent, core PCE inflation was 1.5 percent and the Fed’s bond portfolio was at $3.04 trillion.

No policy changes were made, and George again dissented.

BERNANKE'S MAY 22 APPEARANCE AT CONGRESS

Bernanke first outlined the FOMC’s thinking on tapering in response to questions from lawmakers during an appearance before the Joint Economic Committee of Congress.

“If we see a sustained increase and we have confidence that it’s going to be sustained then we could in the next few meetings … pick up the pace of our purchases,” Bernanke said.

Bond yields rocketed higher and stock prices fell. Financial conditions tightened in the months that followed, surprising the Fed.

POLICY MEETING JUNE 18-19

Policymakers, worried about more communication breakdowns on asset purchases, asked Bernanke to use his press conference to hammer home a point they felt was lost on the market: That any changes to bond purchases would depend on the economic outlook, and that the decision on bond purchases was different from previous ones on interest rates. Unemployment in May was 7.5 percent, core PCE inflation was 1.4 percent and the Fed’s bond portfolio was at $3.14 trillion. No policy changes were made, and George again dissented.

BERNANKE'S TESTIMONY JULY 17-18 FOR THE CONGRESS

Bernanke told lawmakers the Fed remains committed to accommodative policy even after slowing bond purchases, and that it could keep interest rates near zero even after unemployment falls below 6.5 percent. Until then, that is seen as the level at which prices will start to rise.

POLICY MEETING JULY 30-31

Policymakers continue to debate how best to communicate any decision to taper asset purchases, though there is a sense that Bernanke’s June 19 press conference and subsequent congressional testimony convinced markets that any decision would be data-dependent.

Unemployment in June was 7.5 percent, core PCE inflation was 1.5 percent, and the Fed’s bond portfolio was nearing $3.3 trillion.

No policy changes were made, and George again dissented.

SEPT. 17-18 POLICY MEETING

Will the Fed taper its bond purchases, as Wall Street expects, or will the conditions Bernanke laid out in June for doing so not be met?

Unemployment in August was 7.2 percent, core PCE inflation was 1.6 percent and the Fed’s bond portfolio was nearing $3.4 trillion.

Powell was among those advocating for a move at the time. No policy changes were made, and George again dissented.

OCT. 16 VIDEO CONFERENCE

Fed policymakers held an unscheduled video conference to discuss how the central bank would respond if the U.S. government defaulted on its debts as a result of Congress’ refusal to raise the debt ceiling. Congress passed the bill ending the debt ceiling crisis that day, and then-President Barack Obama signed it into law on Oct. 17.

OCT. 29-30 POLICY MEETING

Unemployment in September was 7.2 percent, core PCE inflation was 1.6 percent and the Fed's bond portfolio was nearing $3.6 trillion. No policy changes were made, and George again dissented.

DEC. 17-18 POLICY MEETING

After more than a year of debate, the Fed took its first small step toward unwinding its controversial stimulus.

The Fed said it would reduce the monthly pace of asset purchases to $75 billion, from $85 billion, and added that it would continue to reduce bond purchases in “further measured steps” if the economy continues to perform as expected.

George voted for the policy, but Boston Fed President Eric Rosengren disagreed, calling the move premature.

Unemployment in November was at a five-year low of 6.9 percent, core PCE inflation was 1.6 percent, and the Fed's bond portfolio was nearing $3.75 trillion.

Preparation for the Taper Tantrum Effect in the COVID-19 Era

As the global economy flatlines due to the COVID-19 pandemic, central banks and governments are pumping money into their economies through various stimulus measures. The real worry is that the Fed, which is ramping up bond purchases, will have to rein in quantitative easing once again and raise interest rates. Ratings agency S&P had said earlier this month that while emerging Asia is better prepared than ever to weather an incident like a taper tantrum, countries like India and the Philippines still stand most vulnerable at this point.Both economies have seen inflation pick up in recent months. Real policy rates are below their long-term averages, eroding the return buffer. Capital may be leaving faster and central banks may have to respond by raising policy rates, but one mitigating factor for both economies is that current accounts are stronger than normal. The RBI has cut policy rates by 250 basis points since January 2019, of which 115 basis points came after the countries went into lockdown due to the pandemic.

Given the weak economic recovery, analysts expect interest rates to remain soft at least in the current year. However, other analysts like DK Joshi of Crisil, have told Moneycontrol that central banks across the world will be more cautious in withdrawing stimulus compared to 2013. There is also the issue of India being much more comfortable on the foreign exchange front. As against $275 billion in forex reserves in August 2013, India’s forex currently stands at $582.27 billion.

After studying this taper tantrum, you can search for further information in other media such as books, the internet, or journals that discuss this taper tantrum. Thus the discussion from GICTrade regarding the explanation of Taper Tantrum. You can also find out other information about central banks, investments, and other financial trivia, such as "Arbitrage Trading: Legality, Strategy, to Risk" only in the GIC Journal. Also make sure you deepen your forex knowledge at GICTrade, via scalping ebooks, and also NFP live trading. And don't forget to download the GIC Mobile Apps on the Google Play Store or App Store.

Last:

Last: