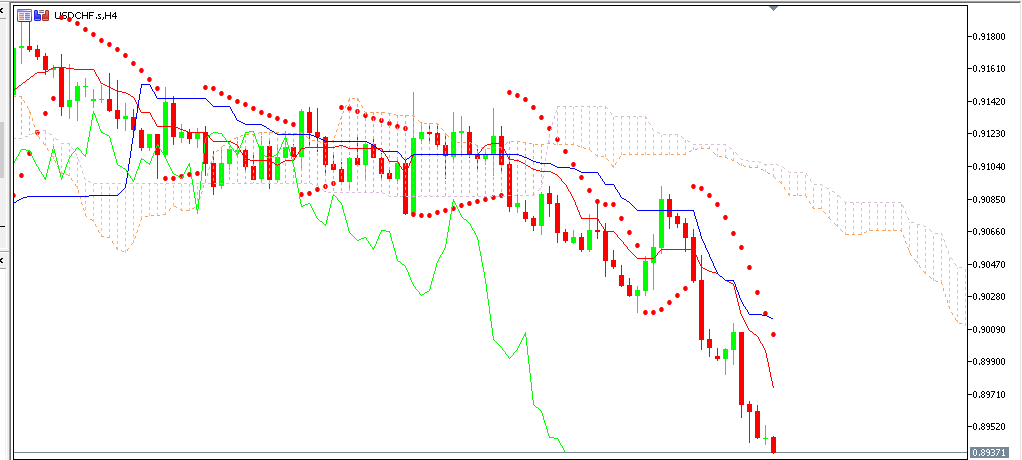

The daily forex analysis of December 03, 2020 will discuss the movement of Franchswiss in the prediction that it will continue its strengthening against the US Dollar. Traders need to remember, that the chart or candlestick chart will decrease if the Franchswiss position strengthens. Today's market movement strengthened the Franchswiss supported by the weakening of the US Dollar. Market participants predict the high possibility of additional US stimulus. US senators and houses of representatives argue that the relief fund due to the coronavirus pandemic is $908 billion. The proposal was rejected by Senate Leader Mitch McConnell, because he had proposed a figure of $1.4 trillion, the goal of which is so that the American government will not experience a "Government Shutdown" in the midst of the Covid-19 pandemic. In a separate place overnight, US Federal Reserve Chairman Jerome Powell, said and reminded that the current economic condition of the United States is still weak. Powell's statement was delivered in front of the US Senate Banking Committee, in addition to Powell also emphasized that Congress should quickly provide a larger amount of stimulus.

Forex Daily Analysis Predictions

Today's FOREX prediction on the USDCHF pair is expected to continue its strengthening (bearish), and the recommended OP (Open Position) is

SELL at the level of 0.89300. With a Target Profit (TP) of 10 - 20 points and a Stop loss (SL) of 5 - 10 points.

| Preference |

BEARISH |

| Target Profit 1 |

0,89200 |

| Target Profit 2 |

0,89100 |

| Stop Loss 1 |

0,89350 |

| Stop Loss 2 |

0,89400 |

This the daily analysis of forex on December 03, 2020. Keep Money Management and Risk Management first in your trading. Visit GIC Indonesia to get information about the world of

trading. You can also join us in the GIC Trade

Telegram Community and GIC Trade

Telegram Channel. Don't forget to check out the GIC Indonesia

Youtube account which is full of a lot of information, and follow our

Instagram account to get information about various interesting webinars that you can participate in

Today's FOREX prediction on the USDCHF pair is expected to continue its strengthening (bearish), and the recommended OP (Open Position) is SELL at the level of 0.89300. With a Target Profit (TP) of 10 - 20 points and a Stop loss (SL) of 5 - 10 points.

Today's FOREX prediction on the USDCHF pair is expected to continue its strengthening (bearish), and the recommended OP (Open Position) is SELL at the level of 0.89300. With a Target Profit (TP) of 10 - 20 points and a Stop loss (SL) of 5 - 10 points.

Last:

Last: